Tuesday December 7th is Colorado Gives Day, an initiative to increase philanthropy in Colorado through online giving. Since the initiative…

READ MOREFundraising, Charitable Giving and Grantmaking

Supreme Court Strikes Down California Donor Disclosure Law

The Supreme Court in Americans for Prosperity v. Bonita struck down a California law that required nonprofits registered in the…

READ MOREFlexible Giving Accounts Legislation Getting Another Look

Last week, the Everyday Philanthropist Act that provides for the creation of “Flexible Giving Accounts” was reintroduced to the House…

READ MOREMovement Capture: A Focus on How Large Funders Can Shift Grassroots Priorities

On the surface, it would seem an organization focused on effecting large-scale social change would—and should—welcome a new major donor…

READ MORESupreme Court Denial Means More Donor Disclosure Required for 501(c)(4)s

We reported recently that the IRS will no longer require exempt organizations other than 501(c)(3)s to disclosure donor information. However,…

READ MORESALT Update: Proposed Regulations Won’t Restrict Business Deductions, But Impact Likely Still Severe

We discussed last week the proposed regulations that will limit the charitable deduction for contributions to state tax credit programs,…

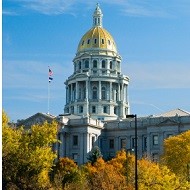

READ MOREChanges to Colorado’s Charitable Solicitation Registration are Effective October 1, 2018

Our friends at the Colorado Nonprofit Association have posted an analysis of the proposed changes to Colorado’s Charitable Solicitation Registration…

READ MORESALT in the Wound: IRS Proposal Could Hinder Longstanding Colorado Tax Credits and Harm Charities

The IRS late last week released proposed regulations that require, in most cases, taxpayers to reduce their federal charitable deduction by…

READ MOREColorado Bill Aims to Spur Charitable Donations for Long-Term Good

Some changes in the recent Tax Cuts and Jobs Act—including a massive increase in the standard deduction that will reduce…

READ MORENew Tax Law Focus: Deduction Sacked for Season Ticket Holders

This post continues our focus on the Tax Cuts and Jobs Act provisions that affect the tax-exempt sector. One change…

READ MORE